What do you do if you need to claim on your house insurance

What do you do if you need to claim on your house insurance due to an emergency?

About a year ago, Sherratt Builders was called to look at a project in Clive, near Shrewsbury, Shropshire.

It was a 4-bed detached bungalow and during a cold spell, the pipes burst in the attic in various places and water began running.

It had been running for days before anyone found it and it ended up being a £200k job.

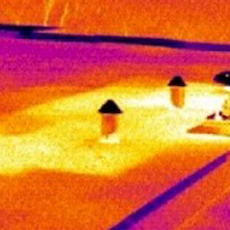

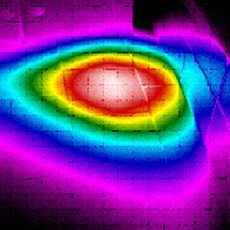

The photos show a very large outbreak of toxic mould and fungi following an escape of water.

The insurance company allowed the property to fester for an incredible seven months (causing a huge amount of mould to grow) before works were authorised to undertake a strip-out.

Sherrat Builders were hired and we had to use specialist breathing apparatus to enable us to undertake the works.

A specialist company was then called in to treat the property and remove all spores and fungi from reappearing.

This just goes to show just how dangerous toxic mould can be when allowed to go untreated. We began the reinstatement works this year.

A lot of people think mould is ok, but when you look at the photos you can see that you couldn’t go in the property without proper respirators on. Exposure to this mould could make you really ill or even kill you.

All the furniture was ruined and we had to strip it out over six weeks. You really have to know what you are doing.

The message is, please talk to us before you speak to the insurers because the insurer on this job got out of it on a technicality.

We see a lot of this unfortunately and that’s another reason why you should never accept a cash settlement from your insurance company if you have an escape of water, as you can get secondary damage and the amount you have will have been offered won’t be enough.

This client had to pay for the work to fix this issue out of own pockets and it cost around £200k.

We had a similar job a few years ago in Yockleton and the insurers also got away with paying out on a technicality because the homeowner had done some DIY and that claim was refused.

It ended up costing the owners £250k because they had done some of their own DIY and plumbing.

It’s important to note the small print on policies which says that you need to use qualified people. If you don’t do your due diligence it can cost you thousands.

As ever, we are here to help and are highly specialised in insurance work and helping you to navigate the insurers.

For any advice, or to look at a project for which you need to make an insurance claim, please call us on 01743 791815 or 07786 268435.